The U.S. Federal Commerce Fee (FTC) sued tax preparation big H&R Block over the corporate’s misleading “free” on-line submitting promoting and for pressuring folks into overpaying for its providers.

H&R Block employs 70,000 tax execs working in over 12,000 workplaces worldwide and has reported a income of $3.5 billion in 2023.

“H&R Block’s on-line tax submitting merchandise lead shoppers into higher-cost merchandise made for extra sophisticated tax filings, regardless of many shoppers not needing the extra tax varieties and schedules supplied by these merchandise,” the FTC said on Friday.

“As well as, H&R Block fails to obviously clarify which of its merchandise cowl what varieties, schedules, or tax conditions, main many shoppers to start out finishing their tax returns in merchandise which are dearer than they want.”

Whereas the corporate’s on-line tax product is advertised as free, a better look reveals a number of points which have drawn scrutiny. The FTC alleges that what H&R Block defines as a “easy return” (the one kind eligible for the free service) is not clearly outlined and might be modified on the firm’s discretion.

Moreover, when customers uncover they do not meet the standards for the free model after inputting all their tax data, they’re nudged towards buying one in all H&R Block’s paid tax submitting merchandise. Nonetheless, navigating between completely different variations proves difficult.

Transitioning to a dearer product is comparatively seamless, with all entered data mechanically transferred, in response to the FTC.

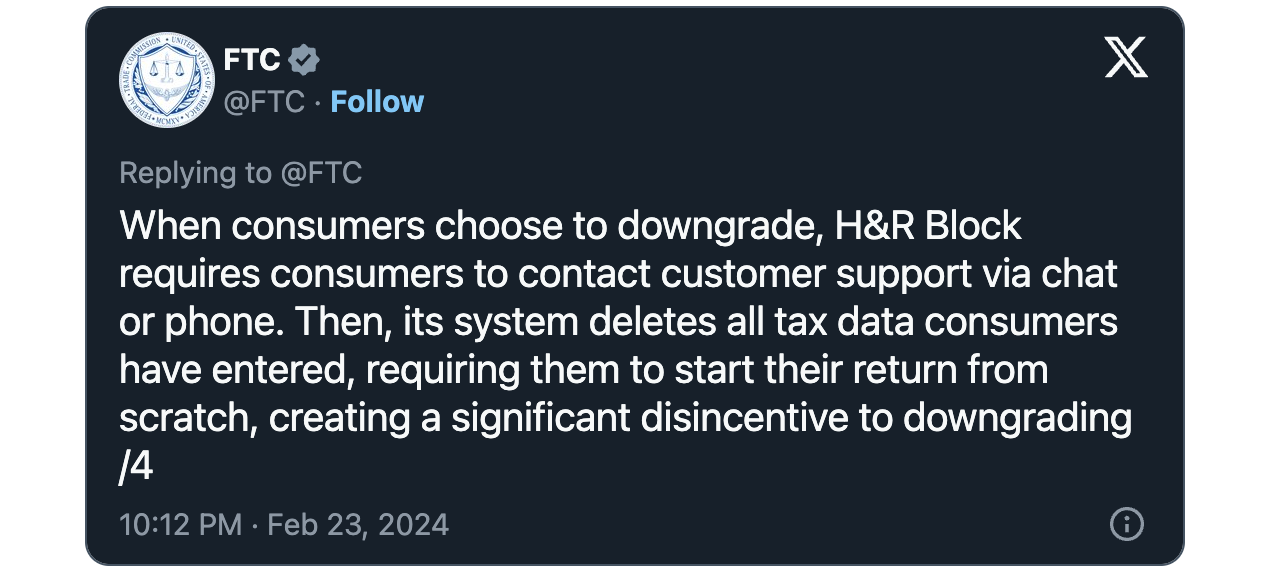

But, making an attempt to modify to a inexpensive model by navigating between completely different variations and with important obstacles hindering customers from downgrading to cheaper choices proves difficult and ends in shedding all information entered through the earlier steps.

“Since no less than 2014, shoppers making an attempt to downgrade have needed to attain out to the corporate to request a downgrade – a course of that has usually been irritating and time-consuming,” the FTC stated.

The FTC additionally alleges that many customers find yourself buying the corporate’s dearer merchandise to keep away from the trouble of re-entering their tax data or because of the problem in reaching customer support for help, with some pissed off customers even abandoning their tax returns altogether after investing and losing important time within the course of.

Along with issues relating to product downgrades, the FTC right now additionally targets H&R Block’s promoting practices, tagging them as misleading.

The criticism says H&R Block has lengthy marketed its on-line tax preparation providers as “free,” however this provide is allegedly deceptive, as many shoppers don’t qualify for the free possibility. It additionally highlights numerous TV and on-line advertisements by H&R Block selling free submitting providers, usually with disclaimers buried in effective print stating that the provide applies solely to “easy returns.”

Nonetheless, the corporate’s advertisements fail to outline what constitutes a “easy return,” and the criticism notes that H&R Block has altered its definition a number of instances lately, resulting in client confusion and frustration.

Dara Redler, the Chief Authorized Officer on the tax preparation firm, advised BleepingComputer that H&R Block has offered a free do-it-yourself (DIY) submitting possibility for over 20 years to help People with their tax filings.

“The multitude of sources we provide to all filers by way of instructional sources, free instruments, and calculators, and The Tax Institute demonstrates our dedication to creating submitting your taxes extra accessible and extra clear for all,” Redler stated.

“Additional, H&R Block permits shoppers to downgrade to a less-expensive DIY Product by way of a number of mechanisms whereas making certain the preparation of correct tax returns.”

The patron safety company additionally ordered TurboTax-maker Intuit final month to cease selling its services as “free” until they’re free for all clients.