At the same time as fast commerce is slowly fading in lots of markets and a number of other heavily-funded startups have folded up to now two years, India is rising as a putting outlier the place the mannequin stays vibrant.

India’s fast commerce market has witnessed a staggering 10-fold progress between 2021 and 2023, fueled by the sector’s potential to cater to the distinct wants of city shoppers in search of comfort for unplanned, small-ticket purchases. Nevertheless, regardless of this speedy enlargement, fast commerce has solely captured a modest 7% of the potential market, with a complete addressable market (TAM) estimated at $45 billion, surpassing that of meals supply, in keeping with JM Monetary.

Zomato’s Blinkit leads the fast commerce market in India, having cornered as a lot as 46% of the market share by GMV within the quarter that resulted in December, in keeping with a brand new evaluation.

Swiggy’s Instamart follows with a 27% share, newcomer Zepto has rapidly gained floor, securing 21% of the market and Bigbasket’s BB Now trails with a 7% share, in keeping with brokerage agency JM Monetary. Reliance Retail-backed Dunzo, which pioneered the fast commerce mannequin in India, has nearly misplaced its whole market share.

“With greater than 10 lively gamers, the area was very aggressive a few years again,” JM Monetary wrote of the fast commerce market in a current observe. “It appeared that an intense section of multi- 12 months cash-burn would quickly observe. Nevertheless, opposite to expectations, a number of gamers together with some well-funded ones folded early of their endeavour. Whereas some confronted funding challenges, a number of others have been affected by structural points similar to lack of product market match, incapability to unravel the hyperlocal complexity, incapability to construct a strong end-to-end provide chain and 4) failure to create a powerful model recall.”

As fast commerce gamers vie for a bigger slice of the market, the success of their ventures hinges on the event of environment friendly provide chains. Firms are making substantial investments in darkish retailer operations, streamlining stock administration, and establishing direct partnerships with FMCG producers and farmers. By circumventing conventional distribution channels, these companies purpose to boost product high quality, expedite supply occasions, and increase general operational effectivity, trade specialists mentioned.

Darkish shops, the spine of fast commerce operations, have considerably expanded their product choices, now carrying over 6,000 SKUs per retailer, a considerable enhance from the two,000 to 4,000 SKUs they housed just some years in the past, mentioned JM Monetary. In distinction, conventional neighborhood kirana shops, that are ubiquitous throughout Indian cities, cities, and villages, usually inventory between 1,000 and 1,500 objects. Massive fashionable retail shops, however, provide a a lot wider choice, with 15,000 to twenty,000 objects out there to clients.

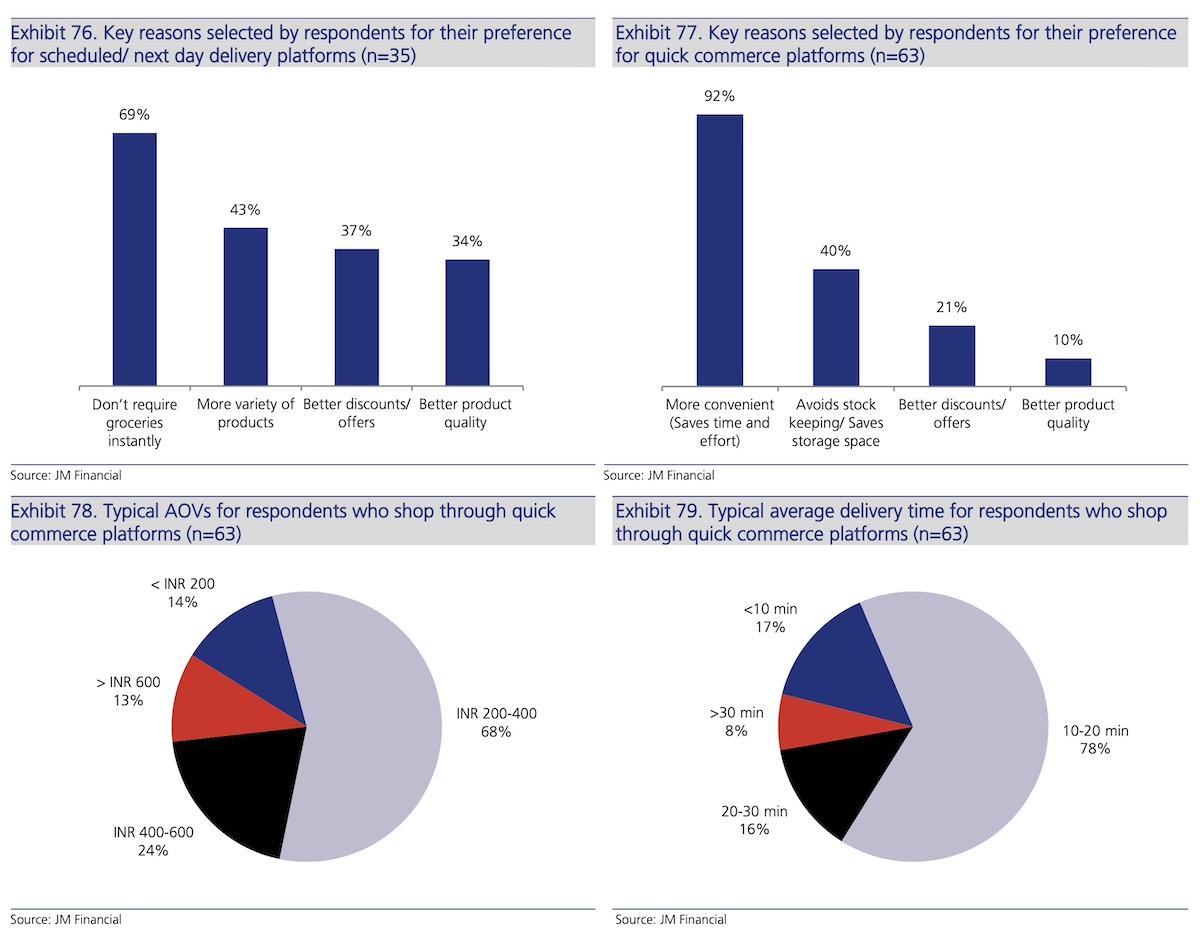

There has additionally been a noticeable surge in common order worth amongst fast commerce gamers, which has risen to round Rs 500 ($6) from the earlier vary of Rs 350 to Rs 400. This enhance in common order worth units fast commerce other than kirana shops, the place clients usually spend between Rs 100 and Rs 200 per transaction.

Whereas the comfort provided by fast commerce is simple, profitability stays a priority for traders. Blinkit — which Zomato acquired in 2022 — goals to realize adjusted EBITDA break-even by the primary quarter of fiscal 12 months 2025, whereas Zepto has set its sights on EBITDA profitability in 2024. Swiggy’s Instamart can also be specializing in profitability, with the father or mother firm indicating that the height of investments within the enterprise is now behind them.

Nevertheless, the long-term sustainability of the fast commerce mannequin stays to be seen. With intense competitors and the fixed want for heavy investments in know-how and provide chain, profitability could show elusive for some gamers. Moreover, the market’s progress potential could also be restricted by the focus of demand in city areas, with smaller cities and rural areas presenting distinctive challenges by way of inhabitants density and client conduct.

And the market could appeal to much more heavily-funded gamers. Flipkart is weighing entering the quick commerce market by as early as Might this 12 months, TechCrunch reported final week.