Monetary fraud prevention is a race towards time. Implementation-wise, it depends closely on the info processing energy, particularly below giant datasets. In the present day, I will share with you the use case of a retail financial institution with over 650 million particular person prospects. They’ve in contrast analytics elements, together with Apache Doris, ClickHouse, Greenplum, Cassandra, and Kylin. After 5 rounds of deployment and comparability based mostly on 89 customized take a look at circumstances, they settled on Apache Doris as a result of they witnessed a six-fold writing velocity and quicker multi-table joins in Apache Doris as in comparison with the mighty ClickHouse.

I’ll get into particulars about how the financial institution builds its fraud threat administration platform based mostly on Apache Doris and the way it performs.

Fraud Threat Administration Platform

On this platform, 80% of ad-hoc queries return ends in lower than 2 seconds, and 95% of them are completed in below 5 seconds. On common, the answer intercepts tens of hundreds of suspicious transactions day by day and avoids losses of hundreds of thousands of {dollars} for financial institution prospects.

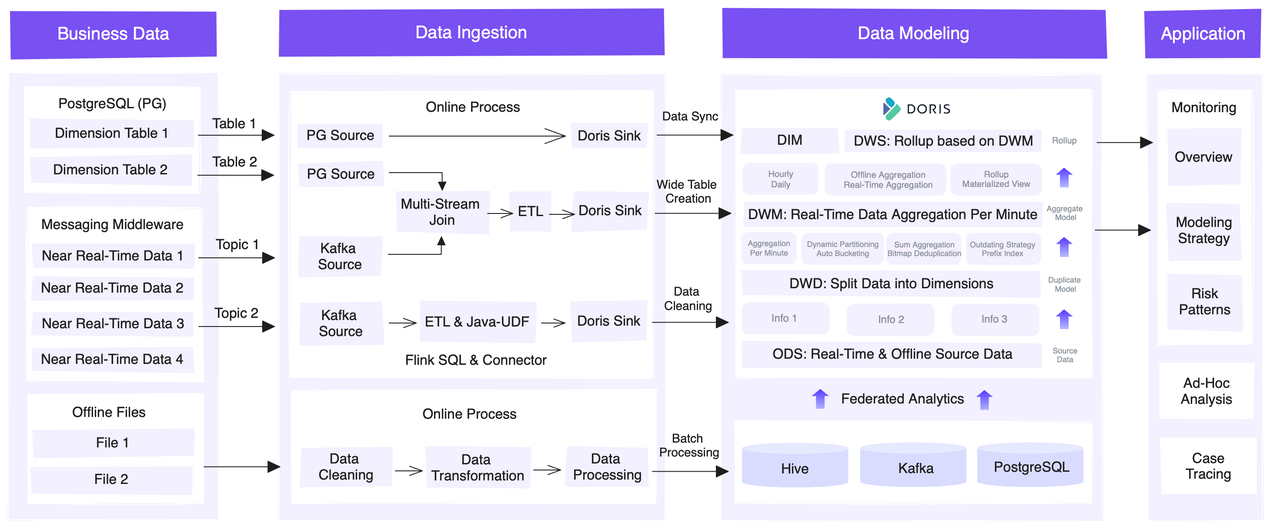

That is an outline of your complete platform from an architectural perspective.

The supply information might be roughly categorized as:

- Dimension information: principally saved in PostgreSQL

- Actual-time transaction information: decoupled from numerous exterior programs through Kafka message queues

- Offline information: straight ingested from exterior programs to Hive, making information reconciliation simple

For information ingestion, that is how they accumulate the three kinds of supply information. Initially, they leverage the JDBC Catalog to synchronize metadata and person information from PostgreSQL.

The transaction information must be mixed with dimension information for additional evaluation. Thus, they make use of a Flink SQL API to learn dimension information from PostgreSQL and real-time transaction information from Kafka. Then, in Flink, they do multi-stream joins and generate huge tables. For real-time refreshing of dimension tables, they use a Lookup Be part of mechanism, which dynamically seems to be up and refreshes dimension information when processing information streams. In addition they make the most of Java UDFs to serve their particular wants in ETL. After that, they write the info into Apache Doris through the Flink-Doris-Connector.

The offline information is cleaned, reworked, and written into Hive, Kafka, and PostgreSQL, for which Doris creates catalogs as mappings based mostly on its Multi-Catalog functionality to facilitate federated evaluation. On this course of, Hive Metastore is in place to entry and refresh information from Hive routinely.

By way of information modeling, they use Apache Doris as a knowledge warehouse and apply totally different data models for various layers. Every layer aggregates or rolls up information from the earlier layer at a coarser granularity. Finally, it produces a extremely aggregated Rollup or Materialized View.

Now, let me present you what analytics duties are working on this platform. Primarily based on the dimensions of monitoring and human involvement, these duties might be divided into real-time threat reporting, multi-dimensional evaluation, federated queries, and auto alerting.

Actual-Time Threat Report

Relating to fraud prevention, what’s diminishing the effectiveness of your anti-fraud efforts? It’s incomplete publicity of potential dangers and premature threat identification. That is why folks at all times need real-time, full-scale monitoring and reporting.

The financial institution’s resolution to that’s constructed on Apache Flink and Apache Doris. Initially, they put collectively the 17 dimensions. After cleansing, aggregation, and different computations, they visualize the info on a real-time dashboard.

As for scale, it analyzes the workflows of over 10 million prospects, 30,000 clerks, 10,000 branches, and 1000 merchandise.

As for velocity, the financial institution now has developed from next-day information refreshing to close real-time information processing. Focused evaluation might be finished inside minutes as a substitute of hours. The answer additionally helps difficult ad-hoc queries to seize underlying dangers by monitoring how the info fashions and guidelines run.

Multi-Dimensional Evaluation To Establish Dangers

Case tracing is one other widespread anti-fraud follow. The financial institution has a fraud mannequin library. Primarily based on the fraud fashions, they analyze the dangers of every transaction and visualize the ends in close to real-time so their workers can take immediate measures if wanted.

For that function, they use Apache Doris for multi-dimensional evaluation of circumstances. They test the patterns of transactions, together with sources, varieties, and time, for a complete overview. Throughout this course of, they usually want to mix over 10 filtering situations of various dimensions. That is empowered by the ad-hoc question capabilities of Apache Doris. Each rule-based matching and list-based matching of circumstances might be finished inside seconds with out guide effort.

Federated Queries To Find Threat Particulars

Aside from figuring out dangers from every transaction, the financial institution additionally receives threat studies from prospects. In these circumstances, the corresponding transaction can be labeled as “dangerous,” and it is going to be categorized and recorded within the ticketing system. The labels be sure that the high-risk transactions are promptly attended to.

One downside is that, the ticketing system is overloaded with such information, so it’s not capable of straight current all the small print of the dangerous transactions. What must be finished is to narrate the tickets to the transaction particulars so the financial institution workers can find the precise dangers.

How is that applied? Every single day, Apache Doris traverses the incremental tickets and the essential data desk to get the ticket IDs, after which it relates the ticket IDs to the dimension information saved in itself. On the finish, the ticket particulars are offered on the entrance finish of Doris. This whole course of takes only some minutes. It is a massive recreation change in comparison with the outdated instances once they needed to manually lookup suspicious transactions.

Auto Alerting

Primarily based on Apache Doris, the financial institution designs their very own alerting guidelines, fashions, and methods. The system displays how all the things runs. As soon as it detects a state of affairs that matches the alert guidelines, it’s going to set off an alarm. They’ve additionally established a real-time suggestions mechanism for the alerting guidelines, so if a newly added rule causes any adverse results, it is going to be adjusted or eliminated quickly.

Up to now, the financial institution has added practically 100 alerting guidelines for numerous threat varieties to the system. Through the previous two months, over 100 alarms had been issued with over 95% accuracy in lower than 5 seconds after the danger state of affairs arose.