Europe is affected by an enormous hangover after the tech funding get together of the 2020-2021 interval. That mentioned, in comparison with pre-pandemic ranges, VC funding in European startups is up, traditionally talking, and reached $60 billion, in response to a brand new report. Nevertheless, the anomaly of the surge in funding over the pandemic stands in marked distinction to that development and has created important headwinds, despite the fact that there are indicators of ‘inexperienced shoots’.

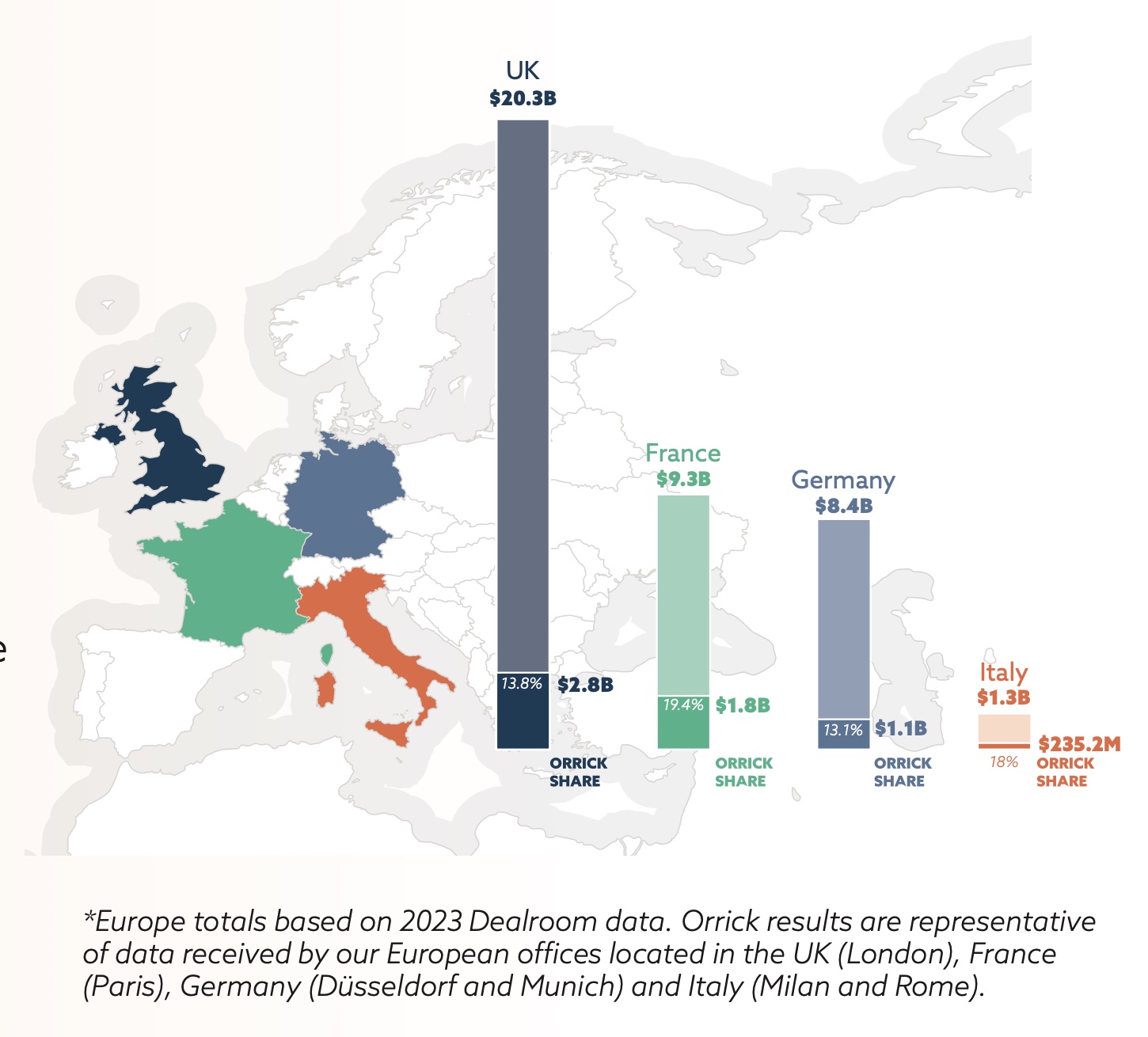

World regulation agency Orrick analyzed over 350 VC and development fairness investments its purchasers accomplished in Europe final yr.

The Complete capital raised in Europe was $61.8 billion. 2023 marked a reset and main correction in funding ranges globally. Of the highest 3 international areas for VC – Europe, Asia, and North America – Europe is the one one to exceed 2019 ranges in 2023.

In response to the report, Europe is sitting on “file ranges of dry powder” and “producing extra new founders than the U.S.”, funding stays gradual.

Solely 11 new unicorns emerged from Europe final yr, the fewest in a decade, and a rising variety of unicorns misplaced their standing.

Local weather Tech overtook FinTech as Europe’s hottest sector

AI’s share of whole funding in Europe soared to a file excessive of 17percent5.

Orrick discovered that traders — emboldened by the downturn in funding — are ‘turning the screws’, exercising better management over investments, with founders being required to face behind warranties in 39% of enterprise offers.

There was a transparent drop in later-stage financings, deal quantity dropped, and founders have been thrown in direction of different methods comparable to different financing strategies, or racing in direction of revenues and earnings.

There was an “unprecedented spike” within the skill of recent traders to enter tech, as founders regarded for brand new lead traders, and an “uptick” in convertible debt, SAFEs, and ASAs, with convertible financings representing 23% of rounds in 2023.

Traders usually centered on managing their present portfolios, secondary transactions elevated, and SaaS and AI continued to be fashionable. Apparently, the variety of FinTech investments declined.

European 2023 tech funding offers (Orrick)

At every stage, deal worth is down, with essentially the most dramatic fall in later-stage offers.

Early-stage deal worth dropped by 40%, despite the fact that early-stage traders are nonetheless essentially the most energetic.

There was a decline in ‘mega-rounds’ exceeding $100M+. Nevertheless, the IPO panorama confirmed “indicators of life” with ARM’s $55 billion IPO, and M&A exercise confirmed “inexperienced shoots.”

Within the UK, VCs are below stress to ship returns, which is prone to result in elevated demand for secondaries, better M&A exercise and consolidation.

In France there’s been a shift from ‘founder-friendly’ phrases in direction of extra investor-friendly phrases, in marked distinction to the Uk, the place the alternative is true.

In Germany, a rising demand from LPs for liquidity is anticipated to “energize the tech M&A pipeline.”